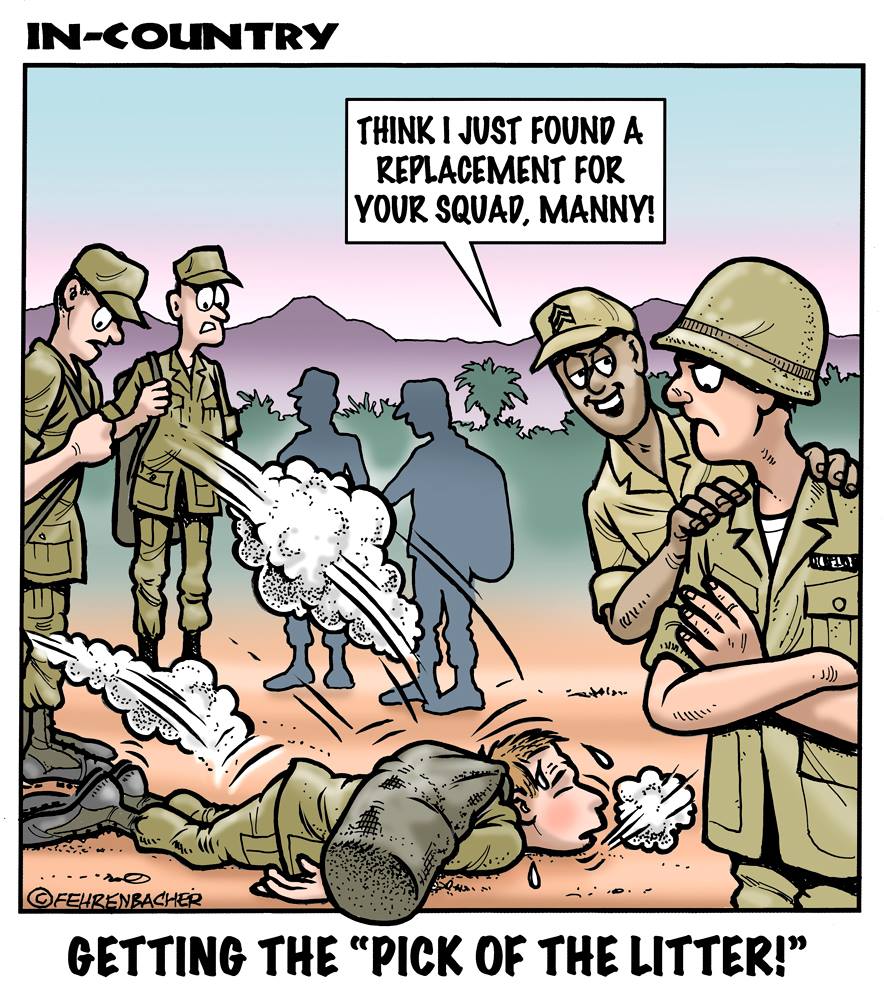

A satirical reflection by Author/Artist Phil Fehrenbacher

Phil enlisted in the Army in 1965 where you served for years in Vietnam. He became a graphic designer and has worked for the state of Oregon for 26 years. He retired in 2003 and started the Cartoon "In-Country". The cartoons reflect his experiences during his tour of duty in South Vietnam.

There is a new cartoon everyday.

Commander Ron Ramos

The Wisconsin Veteran and Military Support Program is available to

Unmet Needs Application Available Here

ANY Veteran or Veteran's family in need. That includes currently-serving Military families.

This is for organizations providing projects or programs thatsupport the charitable and exempt purposes of the VFW Dept. of WI.

FOLLOW US